Energy storage power station sales electricity tax rate

Welcome to our dedicated page for Energy storage power station sales electricity tax rate! Here, we have carefully selected a range of videos and relevant information about Energy storage power station sales electricity tax rate, tailored to meet your interests and needs. Our services include high-quality Energy storage power station sales electricity tax rate-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Energy storage power station sales electricity tax rate, including cutting-edge solar energy storage systems, advanced lithium-ion batteries, and tailored solar-plus-storage solutions for a variety of industries. Whether you're looking for large-scale industrial solar storage or residential energy solutions, we have a solution for every need. Explore and discover what we have to offer!

Sales tax implications in green energy

Grant Thornton shares perspectives on sales and use tax issues for renewable generation facilities, energy storage and electric vehicle charging stations.

Read more

A Sales Tax Boost for the Energy Storage Industry?

The proposed exemption, like the current exemption for solar energy systems, would allow local jurisdictions to opt-out and to continue to impose local sales tax on energy

Read more

Energy Storage Technology Service Tax Rates: What

Welcome to the wild world of energy storage technology service tax rates – where understanding the rules could mean the difference between champagne celebrations and coffee-fueled

Read more

Energy Storage Technology Service Tax Rates: What

Why Tax Rates Are the Secret Sauce of Energy Storage Profits you''ve built a cutting-edge储能电站 (energy storage station), but instead of counting your earnings, you''re stuck deciphering

Read more

Clean Electricity Production Credit

The Clean Electricity Production Credit is a credit available under the production tax credit for businesses and other entities that produce in a qualified clean or renewable energy.

Read more

What is the tax rate for energy storage electricity?

Tax rates for energy storage electricity indeed vary significantly by geographical location. Some areas may impose favorable taxation for

Read more

How much tax does an energy storage power station

The taxation imposed on energy storage power stations varies significantly based on several factors including jurisdiction, the nature of

Read more

How much is the electricity price of energy storage power station

Long-term contracts stabilize the pricing of electricity from energy storage power stations by locking in rates for extended periods. These agreements offer predictability for

Read more

Selling Energy Back to the Grid: Complete Guide

When this order is finally implemented battery storage owners will be able to produce energy, store it on a battery, and sell it back to the

Read more

How much tax does an energy storage power station have

The taxation imposed on energy storage power stations varies significantly based on several factors including jurisdiction, the nature of energy storage technology deployed,

Read more

SALT and Battery: Taxes on Energy Storage | Tax Notes

In this installment of Andersen''s Sodium Podium, the authors discuss the differing property tax and sales tax considerations regarding battery energy storage systems and

Read more

Taxes on Electric Vehicle Charging – KLRD

This memorandum provides information regarding the equivalency in power generated from a gallon of gasoline and a kilowatt-hour (kWh) of electricity. It reviews energy

Read more

Energy Storage Power Station Tax Policy: What Investors and

Let''s face it – tax policies aren''t exactly the sexiest part of renewable energy discussions. But here''s the kicker: understanding these policies could mean the difference

Read more

GST on Solar Power based devices & System

The appellant has relied heavily on the guidelines of the Ministry of New and Renewable Energy for Solar Water Pumping Systems to claim that

Read more

New Mexico Tax Incentives for Renewable Energy Projects

To encourage investment in the renewable energy economy, New Mexico has enacted incentives for individuals and businesses to develop and use renewable energy

Read more

Texas Tax Information for Retail Sellers of Electricity

With regard to electricity, Tax Code Section 182.021 defines a "utility company" as a person that owns or operates an electric light or electric power works, or a light plant used for local sale

Read more

Energy Storage Power Station Tax Situation Report: What

Spoiler alert: tax incentives are playing matchmaker between green energy and profitability. Let''s unpack the tax landscape for energy storage power stations – and why your

Read more

Local Sales and Use Tax on Residential Use of Gas and Electricity

Residential use of natural gas and electricity is exempt from most local sales and use taxes. Counties, transit authorities (MTA/CTD) and most special purpose districts (SPDs) cannot tax

Read more

kWh Billing and New EV Charging Tax Policies: What You Need

The electric car market is experiencing massive growth, exceeding 10 million in sales in 2022. As a result, regulations and guidelines related to electric vehicles are changing

Read more

Tax rate for electricity sold by energy storage power stations

The tax rate for leasing energy storage power stations varies by jurisdiction, with some areas offering incentives, and in many cases, the tax implications can depend on factors such as the

Read more

What is the invoicing tax rate for energy storage power stations?

The invoicing tax rate for energy storage facilities depends on a confluence of local tax laws, eligibility for incentives, and the specific configuration of the energy system.

Read more

Important Notice: State Sales and Use Tax

This document serves as notice that N.C. Gen. Stat. § 105-164.4 (a) (4a) provides the tax rate of three percent (3%) applies to the gross receipts derived from sales of electricity, other than

Read more

Batteries are a fast-growing secondary electricity source for the grid

In 2010, only 4 megawatts (MW) of utility-scale battery energy storage was added in the United States. In July 2024, more than 20.7 GW of battery energy storage capacity was

Read more

Turkey

Approximately 56% of Türkiye''s electric power generation capacity consist of renewable energy, including hydroelectric, wind, solar, geothermal, and biomass power plants,

Read more

What is the tax rate for energy storage electricity? | NenPower

Tax rates for energy storage electricity indeed vary significantly by geographical location. Some areas may impose favorable taxation for renewable technologies, while others

Read moreRelated Contents

- Vietnam photovoltaic panel manufacturers

- Do base station parameters affect the communication module

- Outer diameter of multi-energy photovoltaic energy storage cabinet

- Battery cabinet battery assembly in distribution room

- China Railway Communications Signal Base Station

- Armenia mobile base station power supply manufacturer

- Parallel voltage source inverter

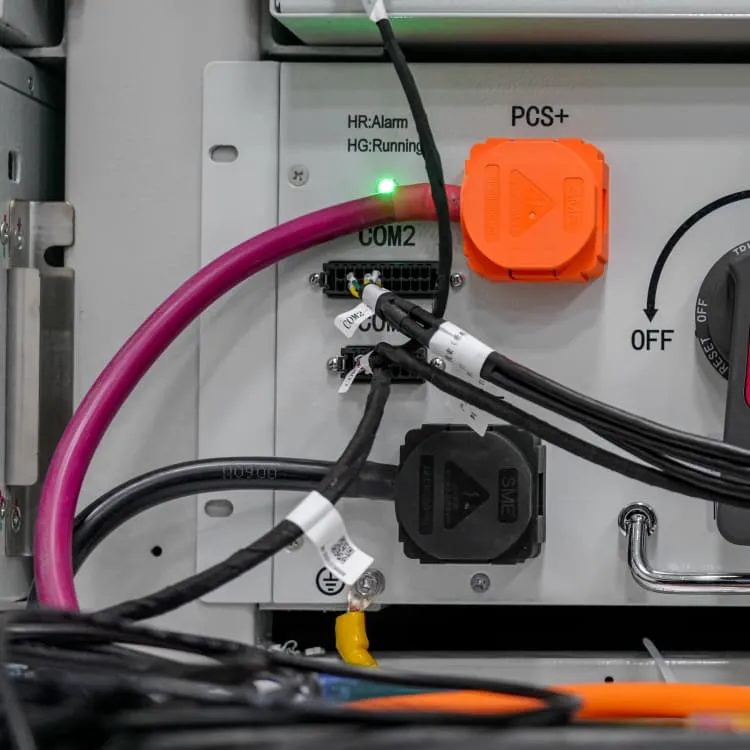

- PCS energy storage liquid cooling

- Photovoltaic panel battery constant voltage module

- Container power generation safety protection

- Portuguese high-end inverter manufacturer

- Namibia Mobile Container Wholesale

- Mali-shaped photovoltaic solar panels

- Dimensions of a 700W solar panel