Energy storage power stations can be exempted from basic electricity charges

Welcome to our dedicated page for Energy storage power stations can be exempted from basic electricity charges! Here, we have carefully selected a range of videos and relevant information about Energy storage power stations can be exempted from basic electricity charges, tailored to meet your interests and needs. Our services include high-quality Energy storage power stations can be exempted from basic electricity charges-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Energy storage power stations can be exempted from basic electricity charges, including cutting-edge solar energy storage systems, advanced lithium-ion batteries, and tailored solar-plus-storage solutions for a variety of industries. Whether you're looking for large-scale industrial solar storage or residential energy solutions, we have a solution for every need. Explore and discover what we have to offer!

SALT and Battery: Taxes on Energy Storage | Tax Notes

Typical exemptions or exclusions available for BESS vary by state and may be based on: if BESS co-locates with a solar or wind facility in a state that provides an exclusion

Read more

Breaking Down the Basic Cost of Energy Storage Power Stations:

Why Energy Storage Costs Matter More Than Ever Ever wondered why your neighbor''s solar-powered home still draws grid electricity at night? The answer lies in energy storage – the

Read more

Electricity import charges: which do battery energy storage pay?

Imports of electricity face different charges in addition to energy costs. This article explains how battery energy storage can be exempt from paying these.

Read more

Pumped storage power stations in China: The past, the present,

The pumped storage power station (PSPS) is a special power source that has flexible operation modes and multiple functions. With the rapid economic development in

Read more

CENTRAL ELECTRICITY REGULATORY COMMISSION

atleast 51 % the annual electricity requirement for charging of the Battery Energy Storage System is met by use of electricity generated from solar and/or wind power plants.

Read more

Battery Storage Technology Tax Credit

Who can use this credit? Existing homes and new construction qualify. Both principal residences and second homes qualify. Rentals do not qualify. This system must be installed in connection

Read more

Blueprint 3A How-To Guide: Solar + Storage Power

The economic benefits of battery storage systems are generally higher for customers with high peak demand charges and/or with time-of-use energy charges that vary significantly.

Read more

Electric Storage Facilities

For Regional Network Service purposes, an Energy Storage Facility''s charging load may be exempt from Schedule 9, so long as it does not include any other loads, or station service load

Read more

GST on services related to transmission and

The applicability of GST on services related to the transmission and distribution of electricity has long been a contentious issue, dating back to

Read more

Identifying State-Focused Renewable Energy Tax

Companies with battery storage at their facility should investigate if storing and releasing electricity qualifies for a sales tax production exemption.

Read more

Understanding Your Utility Bills: Electricity

•Electricity bills can be hard to decipher •Some bills can be very detailed, some are very short •Some charges appear each month, some do not •Understanding your bills and why your

Read more

Ministry of Power

Ministry of Power has issued order today for extension of the waiver of Inter-State Transmission system (ISTS) charges on transmission of electricity generated from solar and

Read more

How much tax does an energy storage power station

The taxation imposed on energy storage power stations varies significantly based on several factors including jurisdiction, the nature of

Read more

What taxes do shared energy storage power stations pay?

Shared energy storage power stations are subject to an array of taxation mechanisms determined by various government levels, including federal, state, and local

Read more

CERC Issues Draft Regulations to Expand ISTS

The Central Electricity Regulatory Commission (CERC) has introduced the draft fourth amendment to its 2020 regulations, expanding the

Read more

MoP releases national framework for promoting

In a bid to accelerate the goal of achieving energy transition from fossil fuel sources to non-fossil fuel based sources and ensuring energy

Read more

What is the basic electricity fee of energy storage power station

The landscape of energy pricing is intricate, particularly when examining the basic electricity fee tied to energy storage power stations. This fee encompasses several elements

Read more

Research on the operation strategy of energy storage power station

With the development of the new situation of traditional energy and environmental protection, the power system is undergoing an unprecedented transformation[1]. A large number of

Read more

Tax-Exempt Entities and the Investment Tax Credit (§ 48 and

Tax-exempt and governmental entities, such as state and local governments, Tribes, religious organizations, and non-profits may install energy-generation and storage property to meet

Read more

Analysis of energy storage power station investment and benefit

In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three aspects of

Read more

Electricity import charges: which do battery energy

Imports of electricity face different charges in addition to energy costs. This article explains how battery energy storage can be exempt from paying these.

Read more

Understanding Your Electric Grid: Policy and Incentives

Congress passed PURPA in 1978, which established rules for generating facilities, called Qualifying Facilities (QFs) to be allowed to sell electricity back to their utility. This set the

Read more

Identifying State-Focused Renewable Energy Tax Exemptions

Companies with battery storage at their facility should investigate if storing and releasing electricity qualifies for a sales tax production exemption. This also applies to charging...

Read more

Sales tax implications in green energy

Taxpayers with battery storage at their facility should determine whether storing and releasing electricity could qualify for a production exemption from sales tax. This also

Read more

Extension in waiver of inter-state transmission charges for

This is extended from June 2023 earlier. ISTS charges waiver is also applicable for electricity used by Hydro Pumped Storage Plant (PSP) and Battery Energy Storage System (BESS) with

Read moreFAQs 6

Who can install energy-generation & storage property?

Tax-exempt and governmental entities, such as state and local governments, Tribes, religious organizations, and non-profits may install energy-generation and storage property to meet energy demands, reach clean energy transition goals, or save money on energy costs.

Do electric vehicle batteries qualify for a sales tax exemption?

Taxpayers with battery storage at their facility should determine whether storing and releasing electricity could qualify for a production exemption from sales tax. This also applies for charging electric vehicle batteries.

Do energy storage systems qualify for a manufacturing exemption?

The Texas comptroller has published at least two private letter rulings explaining that energy storage systems do not qualify for the manufacturing exemption because the batteries are for storing the energy, and storage is not essential to generating the energy. 17

Is battery storage exempt from TNUoS fees?

Battery storage is exempted from the fixed element of TNUoS fees as long as owners have submitted a Non-Final Demand form to National Grid ESO. National Grid provides information on Non-Final Demand declarations here. This means battery owners are only liable for the import tariff, which applies to energy imported during Triads.

Can battery energy storage avoid TNUoS costs?

Because import tariffs only apply to energy imported during the three Triads, battery energy storage can avoid all TNUoS costs by not importing across these periods. Distribution Use of System (DUoS) charges cover the cost of maintaining local distribution networks and depend on the Distribution Network Operator licence area.

Can battery storage be exempt from paying bsuos fees?

Like fixed TNUoS fees, only final demand users are liable to pay BSUoS charges, therefore battery storage can be exempt from paying BSUoS. Battery owners must submit a Non-Final Demand form to National Grid ESO to avoid BSUoS fees. Some charges for electricity consumption support the generation of low-carbon and renewable electricity.

Related Contents

- Honduras mobile portable power wholesale price

- What are the inverters for mine communication base stations

- Zimbabwe Energy Storage Battery Project

- Energy Storage Battery Container Policy

- Are photovoltaic panels installed on the container

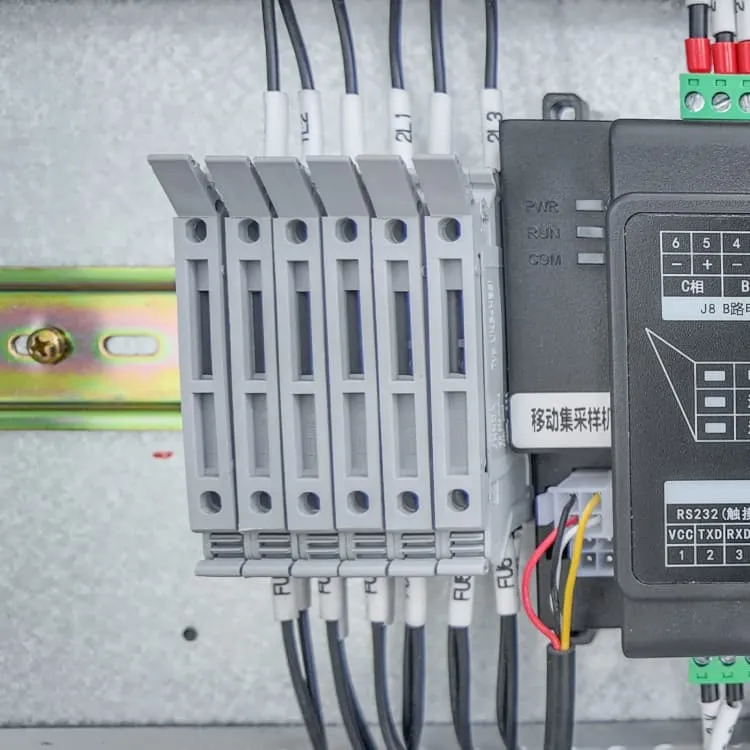

- Detailed explanation of energy storage container grid cabinet

- BMS management of batteries

- Transfer station communication base station wind and solar complementary

- Base station wind power supply

- The power voltage is higher than the inverter voltage

- Abkhazia three-phase inverter

- How many watts of photovoltaic panels are needed to charge a 3 2 volt 30 ah battery

- The latest on flow batteries

- 20W small solar power generation